interest tax shield adalah

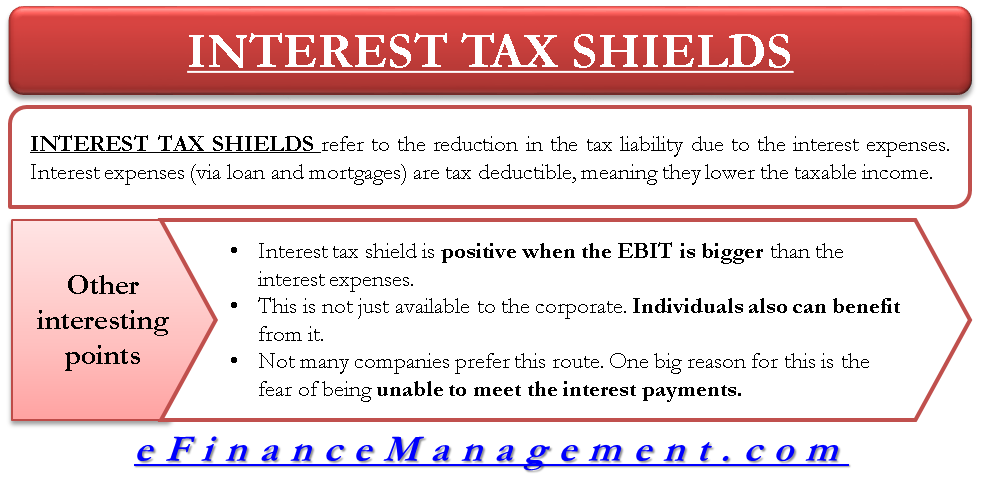

If the tax rate is 10 then the tax liability will be 4000. Definition - What does Interest tax shield mean Tax benefits derived from creative structuring of a financing arrangement.

Pdf Tax Rate And Non Debt Tax Shield

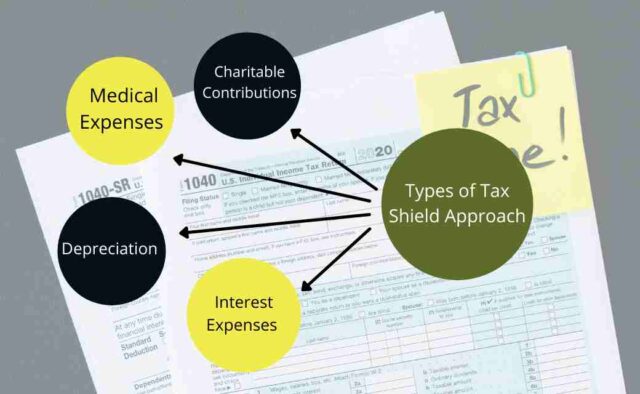

As interest expenditures are tax-deductible tax shields play an important role because the firms can receive benefits from the structuring of the arrangements.

. They can limit the benefits of the company. For example using loan capital instead of equity capital because interest paid on the loans is generally tax deductible whereas the dividend paid on equity is not. Thus interest expenses act as a shield against tax obligations.

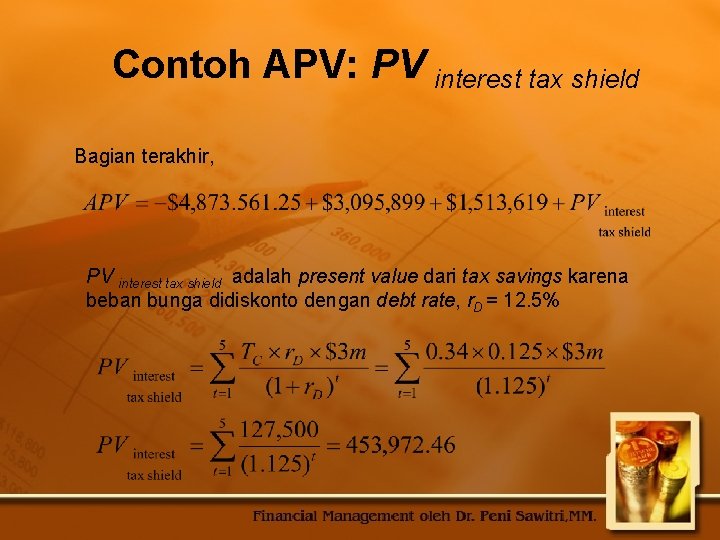

Misalkan arus kas keluar biaya bunga atau gaji adalah 1000 - dan tarif pajak penghasilan adalah 30 persen. For example a mortgage provides an interest tax shield for a property buyer because interest on mortgages is generally deductible. Interest expenses via loans and mortgages are tax-deductible meaning they lower the taxable income.

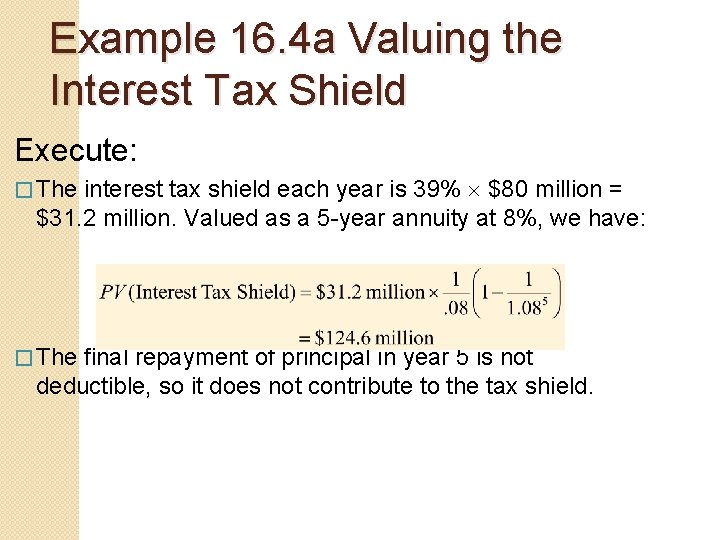

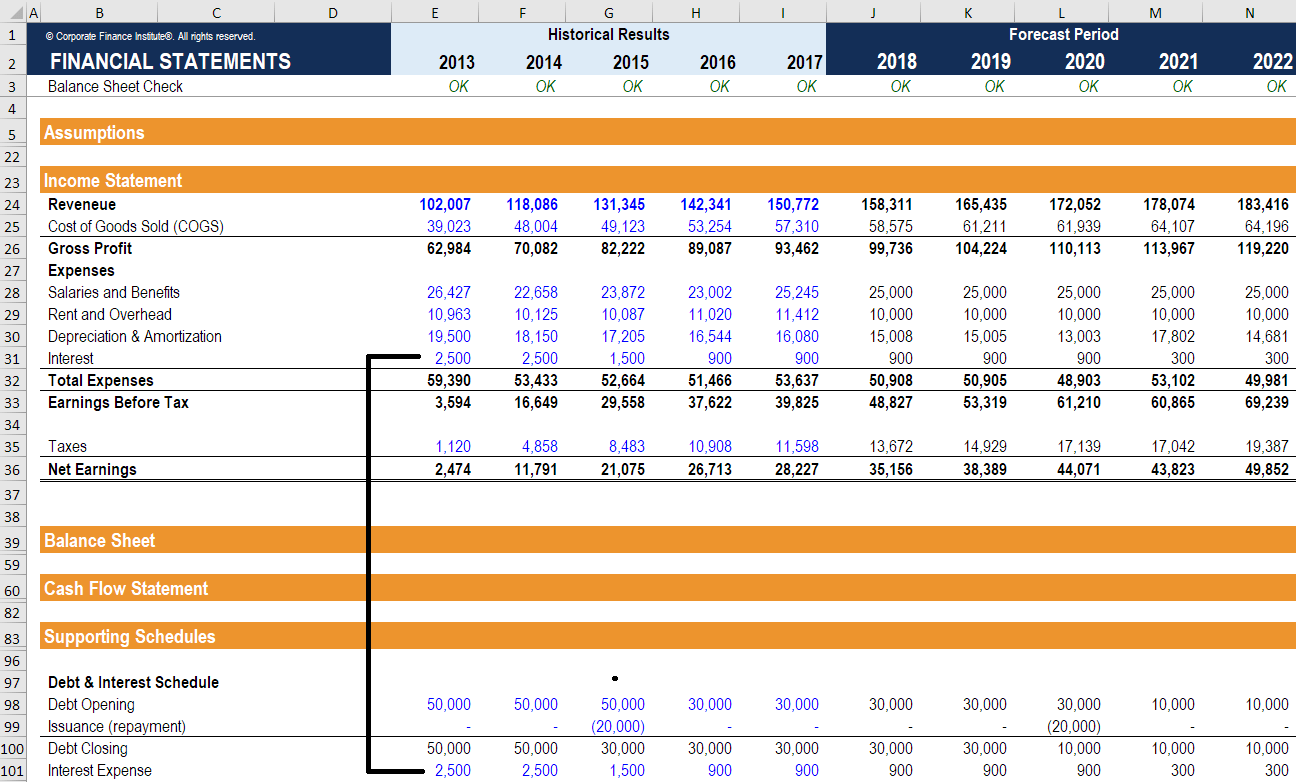

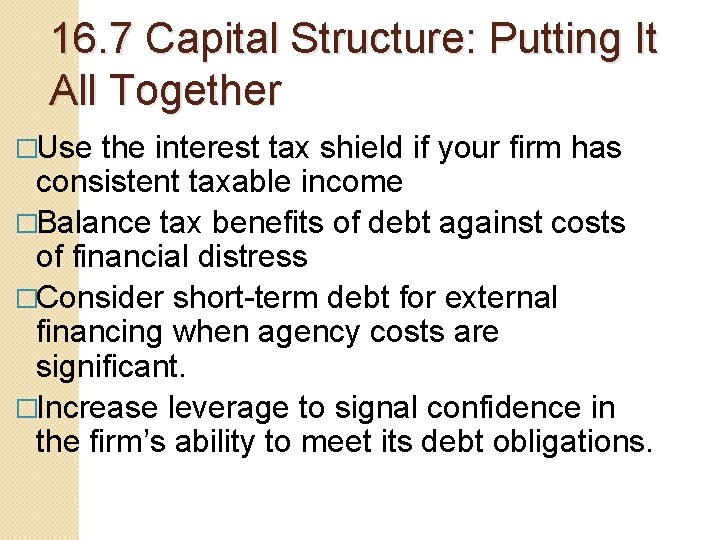

Interest payments are deductible expenses for most companies. These two equations are essentially the same. However issuing long-term debt accelerates interest payments thus maximizing the present value of the interest tax shieldBrick and Ravid 1985 use this logic to argue that debt maturity should increase with the slope in the yield curve.

700 - yaitu 1000 100-30. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the tax rate and D is the depreciation expense. 1 For example because interest on debt is a tax-deductible expense taking on debt creates a tax shield.

The interest tax shield is positive when the EBIT is greater than the payment of interest. The value of tax shields depends on the following. It is because 400 has already been saved or there is 400 less cash flow due to the tax shield.

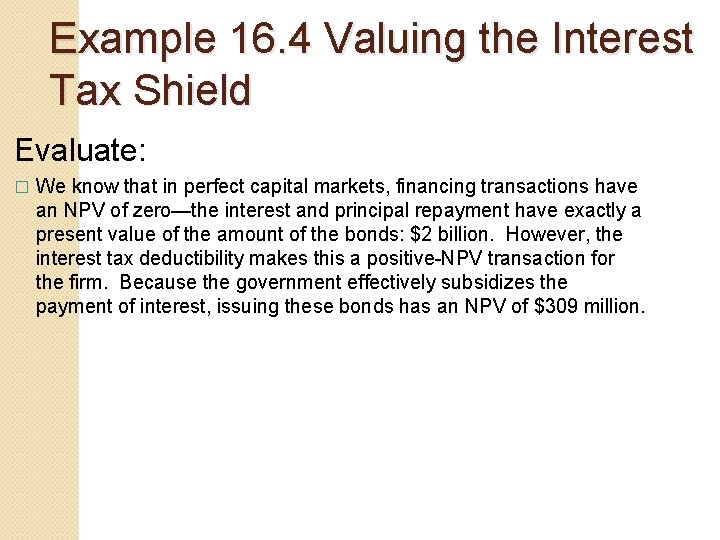

The interest tax shield is positive when the Earnings Before Interest and Taxes EBIT is. Businesses as well as individuals may choose to utilize this type of shield as a means of choosing how to finance different purchases and projects simply to maximize the amount of. The valuation of the interest tax shield capitalizes the total value of the firm and it limits the tax benefits of the debt.

This in turn reduces the total amount of tax payable by the firm. Thus interest expenses act as a shield against tax obligations. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation.

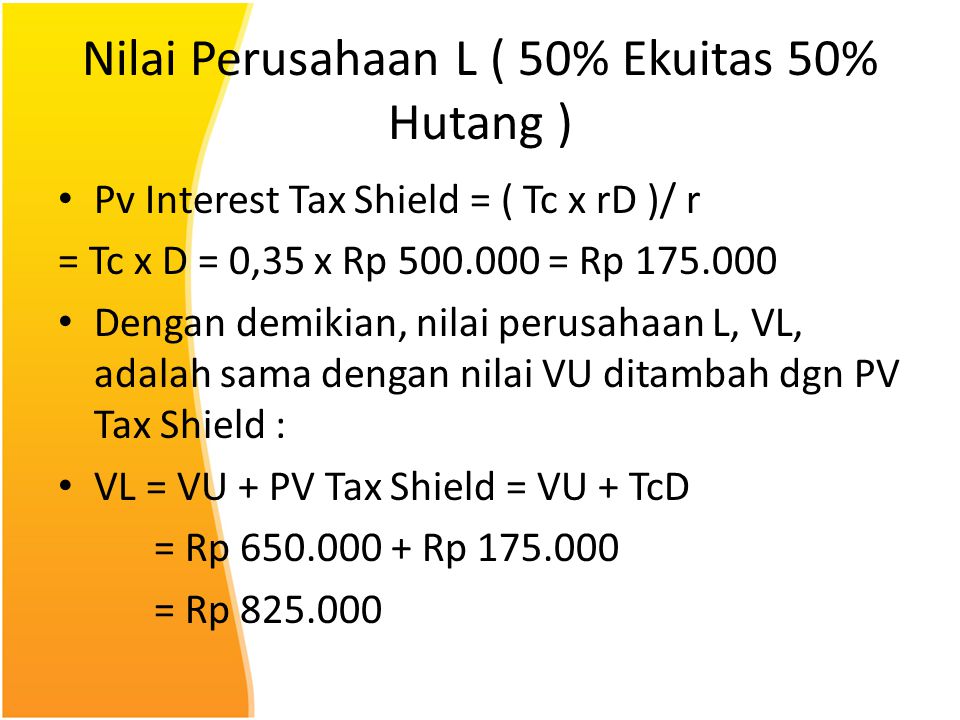

Stated another way its the deliberate use of taxable expenses to offset taxable income. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. So adding back 1600 will add back interest equivalent to 2000. Contoh Tax Shield untuk Perorangan.

1 Since a tax shield is a way to save cash flows it increases the value of the business and it is an important aspect. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

The person gets the benefits while he offsets his taxable. An interest tax shield approach is useful for individuals who want to purchase a house with a mortgage or loan. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation amortization and depreciation.

The effective tax rate of the business. The reduction in income taxes that results from the tax-deductibility of interest payments. By using an interest tax shield a company can maximize its value by limiting the amount of debt it can incur.

For instance Suppose Company A has earned a profit before interest and tax of 40000 for a year. A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income. For example if you expect interest on a mortgage to be 1200 for the year and your tax rate is 20 the amount of the tax shield would be 240.

The amount of the deduction. This strategy also reduces the risk of undervaluation. Tax Shield For Individuals.

But if we avail the option to convert the bond the net value of lost tax shield is 2000 1 20 1600. Interest Tax Shield Interest Expense Tax Rate. The deductible interest paid on debt obligations reduces a companys taxable income.

For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. An interest tax shield may encourage a company to finance a project through debt. The expression CI CO D in the first equation represents the taxable income which when.

The interest tax shield relates to interest payments exclusively rather than interest income. The interest tax shield relates to interest payments exclusively rather than interest income. Interest Tax Shield Example.

The interest tax shields are another way for a business to reduce the risk of debt. If the expectations theory of interest rates holds firms pay the same present value of interest in the long run regardless of debt maturity. Jadi arus kas keluar yang akan dipertimbangkan untuk didiskon adalah.

Calculating the Value of a Tax Shield. CF CI CO CI CO D t. This in turn reduces the total amount of tax payable by the firm.

Moreover this must be noted that interest tax shield value is the present value of all the interest tax shield. This income reduces the taxpayers taxable income for a given year or defers income taxes into future periods. Yang pertama yang secara luas dianggap sebagai efek sampingan yang paling penting dari pembiayaan adalah interest tax shield ITS.

The reduction in income taxes that results from the tax-deductibility of interest payments.

Interest Tax Shield Formula And Excel Calculator

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

Teori Struktur Modal Dan Kebijakan Dividen Ppt Download

Chapter 16 Capital Structure Chapter Outline 16 1

Chapter 16 Capital Structure Chapter Outline 16 1

Interest Expense How To Calculate Interest With An Example

Valuation And Capital Budgeting For Levered Firm Materi

Pdf Tax Rate And Non Debt Tax Shield

Interest Tax Shield Formula And Excel Calculator

Pdf Capital Structure And Managerial Ownership Evidence From Pakistan Semantic Scholar

Defining The Meaning Of Tax Shield Fincash

Interest Tax Shields Meaning Importance And More

Pdf Tax Rate And Non Debt Tax Shield

Pdf Tax Rate And Non Debt Tax Shield

Chapter 16 Capital Structure Chapter Outline 16 1

Pengaruh Profitabilitas Non Debt Tax Shield Dan Karakteristik Perusahaan Terhadap Struktur Modal

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)